When meeting with prospective clients, we explain that the initial Financial Planning comprises of three stages:

- Establish goals/objectives

- Build a financial plan to see if these are achievable (based on a lifetime cashflow)

- Provide Independent Financial Advice

When we build the financial plan, we usually find that our clients will fall into one of three categories before we provide our advice:

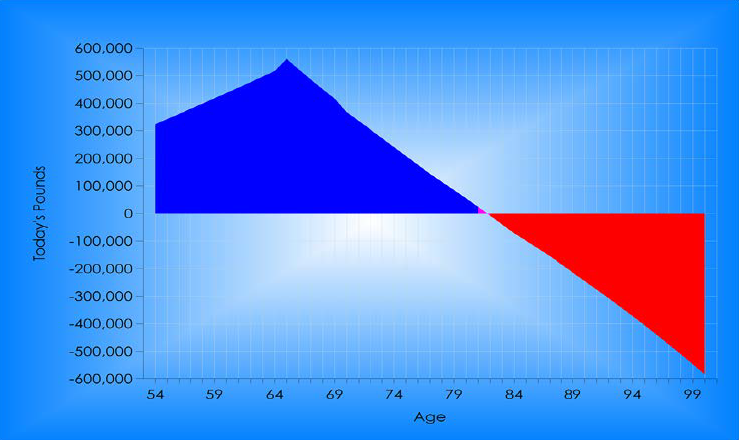

“Not Enough”

Here the lifetime cashflow will turn negative before the plan ends.

Option to rectify this will be 1) Work longer 2) Spend less in retirement 3) Save more now 4) Sell assets or 5) Get a better return on investments.

Each option will have differing lifestyle/personal implication and a combination approach might be suitable.

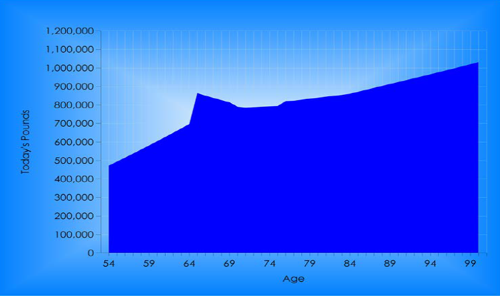

“Too Much”

This is a different situation where the lifetime cashflow continually increases and whilst not wrong in itself, it can be if this is unintentional through fear of spending. As such they could reach later life and look back and say “I wish I had done … and now it’s too late”. In addition, the estate might be paying significant inheritance tax.

So here, spending strategies might be used to help the “Too Much” clients achieve the things they want to achieve. This spending could be on themselves or helping younger generations. I particularly like the phrase “giving with warm hands rather than cold ones”

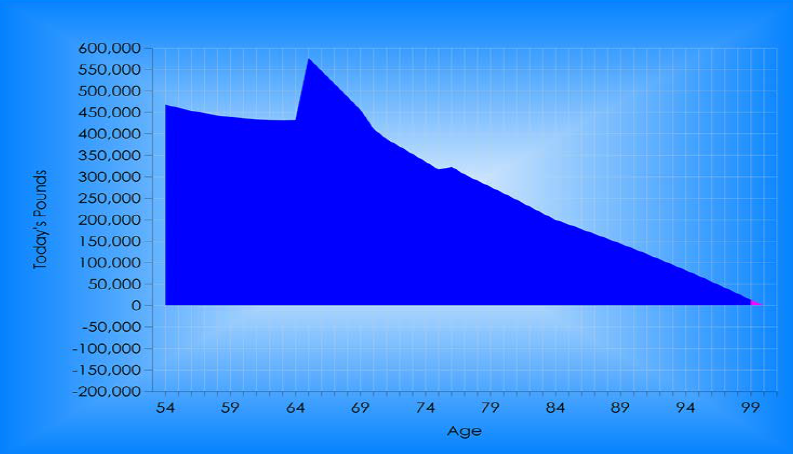

“Just Right”

The “Goldilocks scenario” where the lifetime cashflow results in a legacy that is intended at the plan end but retirement lifestyle is enjoyable and goals reached. In short – a life well lived.

Once we know which category our client fits into we are in a position to provide independent financial advice.

This means the products recommended (investment, pensions, etc), are relevant to the plan which is bespoke to our client’s personal lifestyle objectives.

Feedback is clients can then see a direct reason why they have the investments/pensions and this can really help during times of market turmoil.

So, which category are you?