Well, who would have thought four years ago we would have President Trump and Prime Minster Johnson? Certainly not me.

Over the long run, the market has provided substantial returns regardless of who lives at Number 10.

What the effect of having Boris Johnson as PM no one can say with certainty. However, below, we explain why investors would be well-served avoiding the temptation to make significant changes to a long-term investment plan based upon these sorts of predictions.

Trying to outguess the market is often a losing game. Current market prices offer an up-to-the-minute snapshot of the aggregate expectations of market participants— including expectations about the outcome and impact of elections. While unanticipated future events (genuine surprises) may trigger price changes in the future, the nature of these events cannot be known by investors today. As a result, it is difficult, if not impossible, to systematically benefit from trying to identify mispriced securities. So it is unlikely that investors can gain an edge by attempting to predict what will happen to the stock market after a general election.

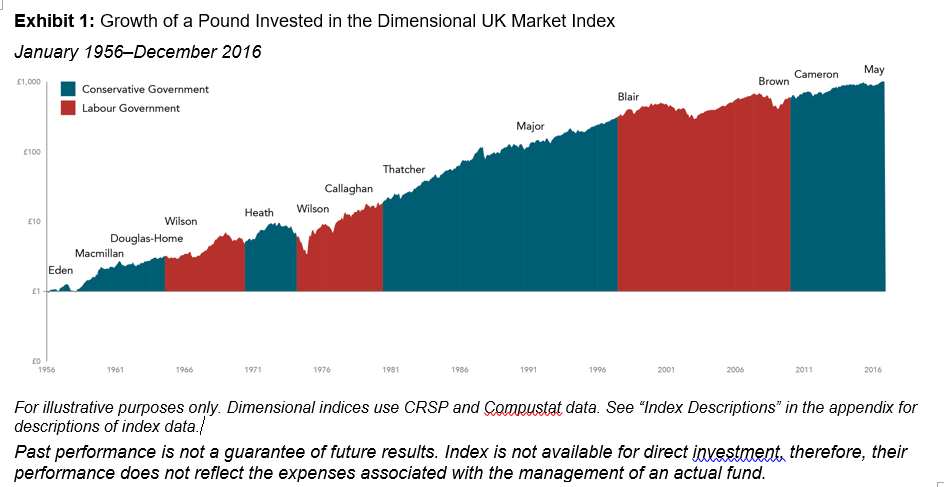

Exhibit 1 shows the growth of £ 1 invested in the UK market over more than 60 years and 12 prime ministers (from Anthony Eden to Theresa May). The chart does not extend beyond 2016 but it is the long term trend we are looking at, not returns over a short period, say 3 years.

This exhibit does not suggest an obvious pattern of long-term stock market performance based upon which party has the majority in the Commons. What it shows is that over the long run, the market has provided substantial returns regardless of who lives at Number 10.

Equity markets can help investors grow their assets, but investing is a long-term endeavour. Trying to make investment decisions based upon the outcome of predictions is unlikely to result in reliable excess returns for investors. At best, any positive outcome based on such a strategy will likely result from random luck. At worst, such a strategy can lead to costly mistakes. Accordingly, there is a strong case for investors to rely on patience and portfolio structure, rather than trying to outguess the market, in order to pursue investment returns.

Warm RegardsNeil

Dimensional UK Market Index: Compiled by Dimensional from Bloomberg securities data. Market capitalisation-weighted index of all securities in the United Kingdom. Exclusions: REITs and investment companies. The index has been retroactively calculated by Dimensional and did not exist prior to April 2008.

This article should not be considered investment advice or an offer of any product for sale, it contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular, strategy or investment product. Information contained has been obtained from sources believed to be reliable, but is not guaranteed. Past performance is not an indicator of future results.