These are wise words from the famous economist Milton Friedman and a tongue in cheek way of highlighting the issues of using averages in financial planning.

Thinking of this in another way, imagine you are invited on a mystery four-week holiday and must pack your own luggage, but the only information given to you is that the average temperate is 20°C. You choose to pack light summer clothes and perhaps some warmer clothes for the cooler evenings. However, when you arrive at your destination you discover you will be spending two weeks in northern Europe where it is currently 0°C, followed by two weeks near the equator where it is 40°C. What would you do?

This analogy is quite relevant in financial planning, as often yearly averages are used when looking at the past performance of investments.

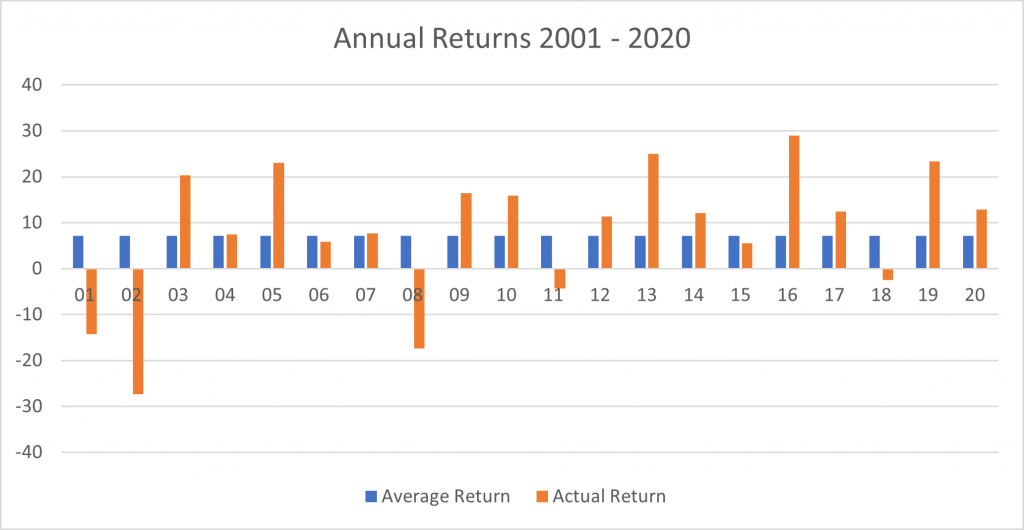

For example, if we take the MSCI World Index over the last twenty years we see an average return of 7.10%.1

So, it might seem reasonable to assume that if we invested £100,000 at the start of the period we may have enjoyed a £7,100 gain per year.

However, Table 1 below shows the actual yearly returns that averaged at 7.10% per annum compared to a return of 7.10% each year.

Table 1

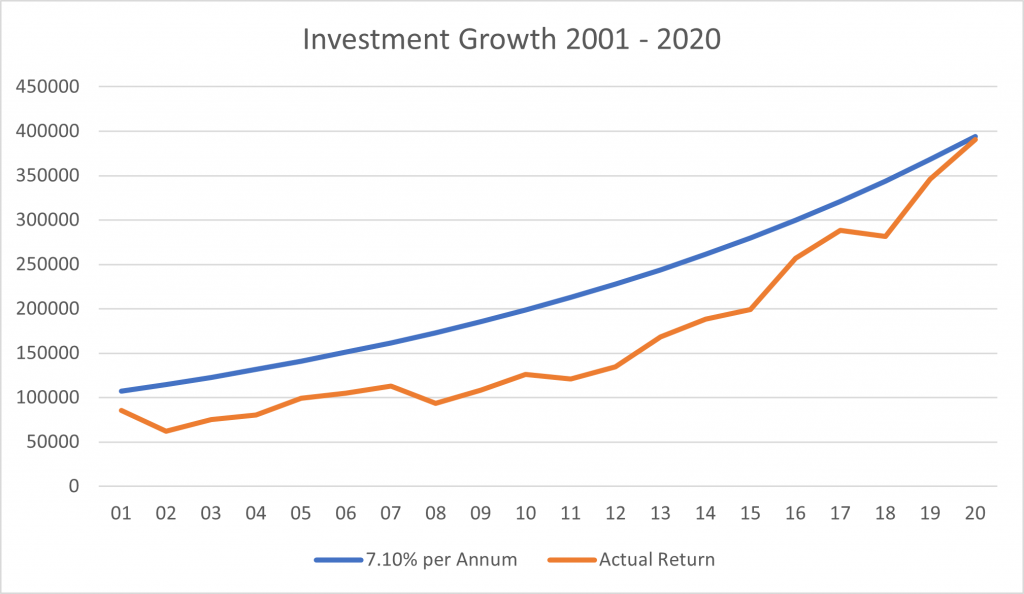

Table 2 then shows the investment growth on £100,000 again comparing a return of 7.10% each year compared to the actual return.

Table 2

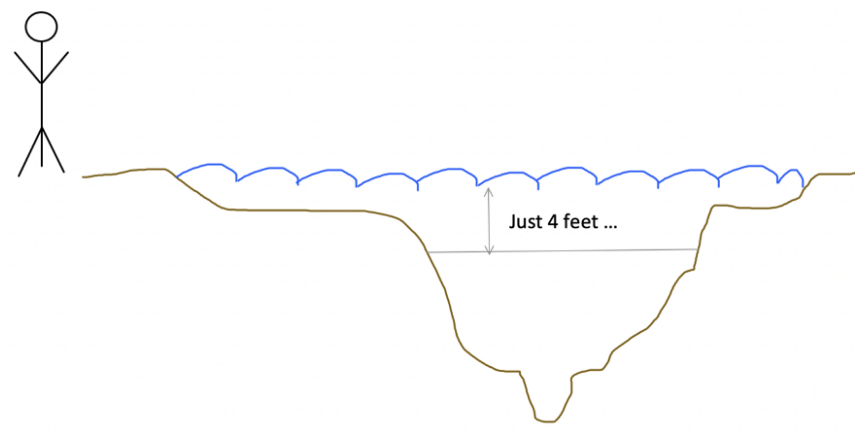

Expecting a return on your investment of 7.10% per annum, but actually seeing your investment fall to -27.3% as in 2002 could be a very unpleasant experience – the same as freezing in 0°C on the mystery holiday for two weeks in only your shorts and a T shirt! Might you sell your summer clothes at a loss to buy an expensive winter coat in the hope it will protect you from the cold? Possibly, but imagine if you had been able to ask for advice before packing for the trip?

At Blackdown Financial we believe that the dominant factor determining the returns that an investor receives is investor behaviour, not investment performance.

We know we can’t rely on past performance as an indicator for future returns, however we can prepare our clients to accept that in the short-term investments, like the temperature, will rise and fall. This reduces the likelihood of an investor panic selling their investments at a loss rather than taking advantage of the ‘sale prices’.

Having a diversified portfolio of the great companies of the world at low cost with regular rebalancing is the best way we know to build wealth over time. It is simple but not necessarily easy.

Therefore, working with an Independent Financial Adviser can be helpful to:

- Build a plan to work towards goals/ideal lifestyle

- Arrange appropriate investments as per the needs of the plan

- Update the plan, review the investments, and protect them from the human emotions we all have

Warm Regards

Neil

1 – Source: Dimensional Matrix Book 2021