When we talk about capital, in our experience most people automatically think of money – this is correct but it is only one form of capital. There are other equally (if not more important) types of capital.

The most important is Human Capital – our ability to create other forms of capital.

For example, if we study in a certain field and increase our knowledge and abilities then in a free market all things being equal, we will be able to command more financial capital (aka money) in exchange for our human capital. This is one of the principles of capitalism but clearly, there are examples where this relationship does not always hold true.

Let us focus on the interaction of human and financial capital with reference to financial planning.

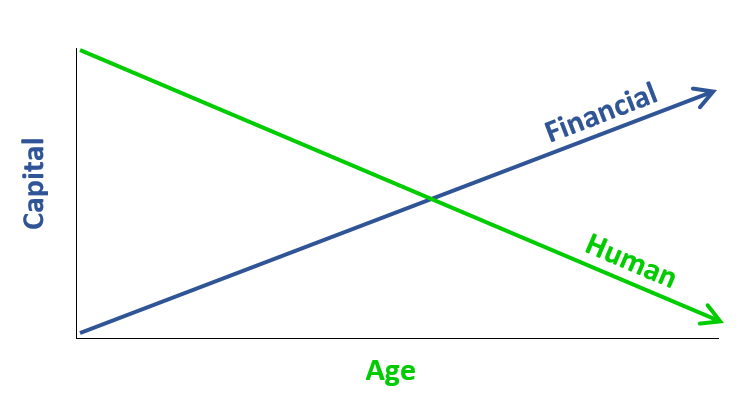

When we are young our human capital is high, we have years of work ahead of us and the ability to learn new skills and acquire new knowledge. By contrast, our financial capital may well be low as we are just starting out on a career.

To acquire financial capital requires us to defer consumption now (in other words to save by spending less then we earn) This deferral of consumption provides the financial capital which our future selves will need to maintain our chosen lifestyles.

As we age our human capital decreases and in the ideal world our financial capital is increasing.

Once we reach the point when our financial capital is sufficient for our needs, we could choose to stop work (i.e. stop creating more financial capital) This does not address the desire for a sense of purpose most people have, so we might choose to continue to create financial capital because we enjoy the job. Alternatively, we might choose some vocation which does not pay i.e. volunteering to create our sense of purpose.

A good way to visualise this is –

Unless we plan to work until we die then it is imperative to use our human capital to firstly create financial capital and then defer consumption of some of this. In practice, this might sound simple but the reality is often anything but. Two reasons for this could be:

- The consumer world we live in with the desire for the latest new “shiny” object (do we really need a slightly upgraded smartphone every year?). As I read somewhere “some people spend money on things they don’t need, they can’t afford and to impress people they don’t know”.

- Many things in life that are simple are easy, while most things that are complex are hard but investing is one of those rare phenomena that is at once very simple and very hard.

So given the lockdown we are experiencing and the reduced consumption that seems to be occurring perhaps now is an ideal time to reflect on ways to increase our human capital by developing ourselves and our financial capital by considering our level of consumption when we return to some semblance of normality.

This article should not be considered investment advice or an offer of any product for sale, it contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular, strategy or investment product. Information contained has been obtained from sources believed to be reliable, but is not guaranteed. Past performance is not an indicator of future results.