You may have read that well-known share indices in the US and Europe have reached new highs in recent months. Is a new market high an indication that it is time for investors to cash out?

History tells us that a market index being at an all-time high generally does not provide actionable information for investors. For evidence, we can look at the performance of the MSCI World Index for the better part of the last half-century.

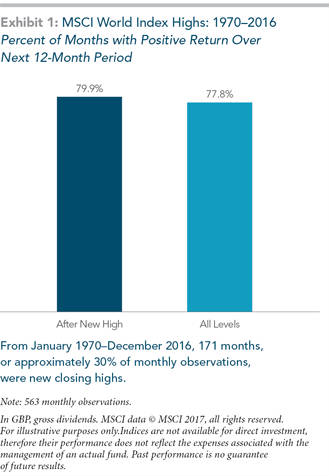

From 1970 to 2016 (see Exhibit 1), the proportion of annual returns that have been positive after a new monthly high is similar to the proportion that have been positive after any index level.

In fact, almost a third of the monthly observations were new closing highs. Looking at this data, it is clear that new index highs were not useful predictors of future returns.

So, if the level of an index by itself does not have a bearing on future returns, what does?

One way to compute the current value of an investment is to estimate its future cash flows and calculate their value today. This type of valuation method allows expectations about a firm’s future profits to be linked to its current share price through a “discount rate”. This rate is equal to an investor’s expected return. This valuation method tells us that the expected return from holding a share is driven by a combination of the price paid for it and what its investors expect to receive.

Share prices are the result of the interactions of many willing buyers and sellers. If investors apply positive discount rates to the cash flows they expect to receive from owning a share, they should expect the price of that share to represent a level such that its expected return is positive. It is extremely unlikely that, in aggregate, willing buyers of shares apply negative discount rates to the expected profits of the firms they are purchasing. If they did, it would imply they collectively expect a negative return on investment. If this were the case, why would they buy at all?

Therefore, it is reasonable to assume that the price of a share, or the price of a basket of shares like the MSCI World Index, should be set to a level at which its expected return is positive, regardless of whether or not that price level is at a new high.

It is important to make the distinction between expected and realised returns. The latter may be negative or positive because of changes in expectations. If either expected returns or expectations about future profits change, prices will also change to reflect this new information. Changes in risk aversion, tastes and preferences, expectations about future profits, or the quantity of risk can all drive changes in expected returns.

This all helps explain why new index highs have not, on average, been followed by negative returns. At a new high, a new low or something in between, expected returns are positive.